- By 小编

- 2025-06-13 10:18:52

- TECHNICAL

How Coreless and Frameless Torque Motors Are Reshaping the Robotics Industry Chain

1. Core Motor Classification and Technological Evolution

1.1 Motor Categories and Core Characteristics

A motor is a device that converts electrical energy into mechanical energy, operating based on electromagnetic principles—generating rotational or linear motion through the interaction between current and magnetic fields. As a fundamental component in modern engineering and technology, motors play a crucial role in driving machinery, providing power, and enabling control systems. With ongoing technological advancements, motor performance and efficiency continue to improve to meet diversified demands.

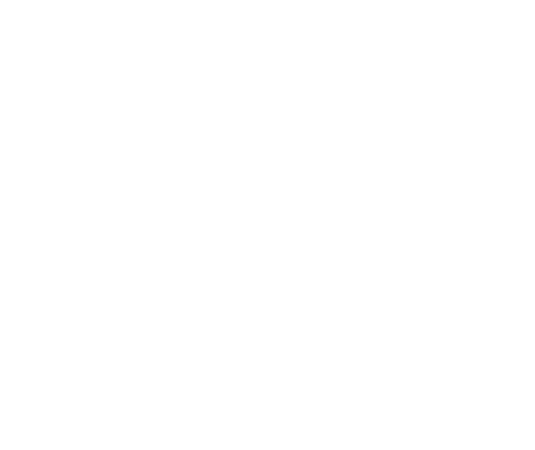

According to the type of power supply, motors can be divided into DC motors and AC motors.

DC motors are powered by direct current and convert DC electrical energy into mechanical energy. Their advantages include stable speed, high starting torque, and high efficiency. However, their complex structure, maintenance difficulty, and higher cost limit their application to fields such as machine tools, robotics, electric vehicles, and ships.

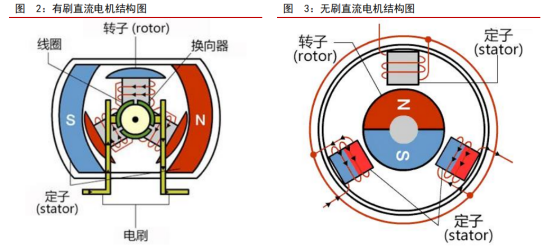

Brushed DC motors use mechanical commutation, with fixed magnetic poles and rotating coils. Commutation is achieved through contact between brushes and the commutator. These motors are simple in structure and mature in technology, with characteristics such as high starting torque, fast response, and high control precision (up to 0.01 mm).

Brushless DC motors (BLDC) use electronic commutation, with fixed coils and rotating magnetic poles. They rely on Hall sensors to detect the magnetic pole position and switch current direction accordingly. With no brush wear, they offer long service life, low noise, and low maintenance cost.

AC motors are powered by alternating current and convert AC electrical energy into mechanical energy. They are known for their durability, low manufacturing cost, and ease of use, and are widely applied in consumer products and industrial equipment.

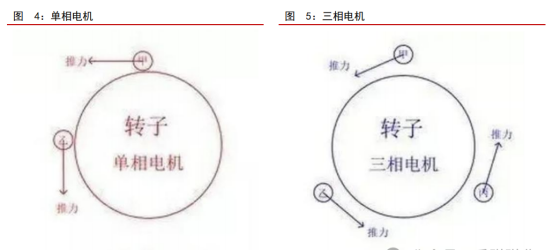

Single-phase motors use single-phase AC to generate a magnetic field that drives the rotor, requiring a starting capacitor to initiate rotation. They have simple structures and low costs, making them suitable for household appliances like fans and vacuum cleaners.

Three-phase motors consist of three sets of coils spaced 120 degrees apart and use three-phase AC to create a rotating magnetic field that drives the rotor. With high operating efficiency, strong stability, and long lifespan, they are mainly used in industrial pumps, fans, and compressors.

In terms of functional use, control motors serve as actuators for precise speed and position control, primarily including:

Step motors convert pulse signals into angular displacement. The number of pulses controls displacement, and pulse frequency controls speed. They are simple in structure, highly reliable, and used in automatic feeders, printers, etc.

Servo motors convert voltage signals into mechanical output. Feedback from encoders enables closed-loop control. They are characterized by high precision, fast response, strong stability, and high output torque, making them ideal for high-precision control systems.

Torque motors focus on output torque as the core control parameter, eliminating mechanical transmission components. With high torque output and precise control capabilities, they are applied in machine tools, automated production lines, and robotic joints. They are classified into frameless and housed types.

On the policy front, the "Mechanical Industry Stabilization Work Plan (2023–2024)" emphasizes enhancing industrial capabilities and achieving breakthroughs in core technologies, promoting advancements in motor technology. The "Implementation Opinions on Promoting Future Industrial Innovation and Development" designates humanoid robots as a key breakthrough area, strengthening the strategic role of motors as core components of robots.

2. Coreless Motors: Technical Features and Industrial Ecosystem

2.1 Technical Principles and Classification

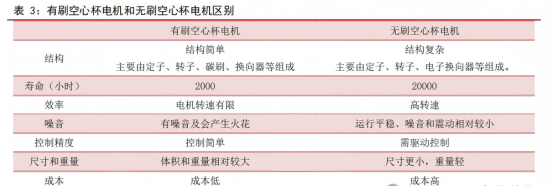

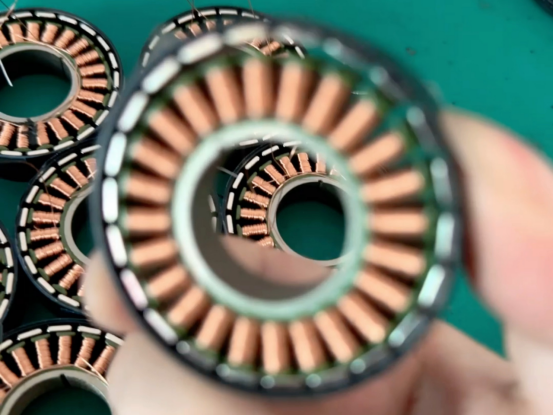

As a specialized type of DC permanent magnet servo motor, the coreless motor’s core innovation lies in its ironless rotor design. The structure includes a shaft, bearings, cup-shaped windings, and a radially magnetized ring magnet (stator), with the slotted cross-section of the magnet being a defining feature. The two main technical categories are brushed and brushless: brushed coreless motors use mechanical contact between carbon brushes and commutators for current transmission. Although simple and low-cost, brush wear causes spark noise and shortened lifespan, limiting high-end applications. They are primarily used in small home appliances. Brushless coreless motors use electronic commutation to switch current direction, eliminating contact wear and significantly improving size, efficiency, and lifespan, making them ideal for drones, robotic joints, and precision medical devices.

Thanks to the slotless structure and suspended winding technology, these motors demonstrate three core advantages: first, exceptional energy efficiency, with energy conversion efficiency more than 15% higher than traditional motors; second, uniform torque at low speeds, ensuring smooth operation of precision equipment; third, strong vibration and noise suppression at high speeds, reducing amplitude by up to 30 dB.

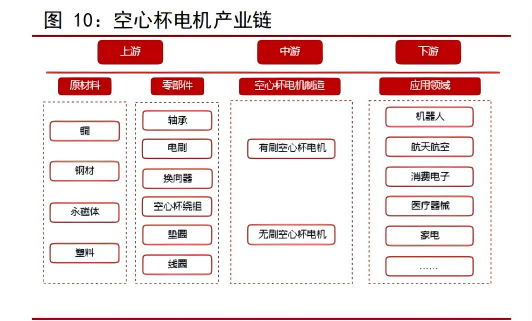

2.2 Industry Chain and Barriers to Entry

The coreless motor industry chain includes three major segments: upstream raw materials, midstream manufacturing, and downstream applications. Upstream materials focus on copper (winding conductor), neodymium iron boron magnets (magnetic poles), and high-precision bearings, with magnets accounting for 35% of the cost. The core bottleneck in midstream manufacturing lies in the coil winding process. Three major winding types—linear, saddle-shaped, and skewed—correspond to different power densities and space efficiencies. The skewed winding process can increase power density up to 400 W/kg.

Downstream applications are diverse. In China’s 2023 market, medical devices accounted for the largest share at 37%, followed by warehouse logistics (15%), industrial automation (12%), and robotics (8%). The industry faces three major barriers:

Technical barriers stem from the precision required for suspended winding. Wire diameter tolerances must be ≤0.01 mm, and winding count deviation ≤±1 turn; otherwise, motor parameters may drift by over 5%.

Customization barriers arise from deep integration with customers. For example, surgical robot joint drives must match specific torque curves, making it hard for new players to break into existing collaborative networks.

Capital barriers are reflected in the need for heavy asset investments such as high-speed automatic stamping presses (≥2 million RMB per unit) and precision rotor production lines (≥5 million RMB per line). Annual R&D spending must consistently exceed 15% of revenue.

2.3 Competitive Landscape and Market Potential

The global market is highly concentrated. In 2023, overseas companies held 85% of the market, with the top five accounting for a 67% combined share. Germany’s Faulhaber leads with micro motor precision control, while Switzerland’s Portescap excels in high power density design. U.S.-based Allied Motion specializes in customized solutions.

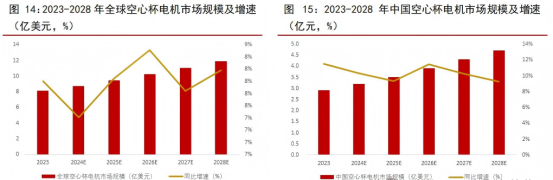

Market growth is driven by two engines: the trend toward more precise medical devices pushes annual demand growth over 10%—for instance, a Da Vinci surgical robot requires six coreless motors per unit; the humanoid robot boom opens new demand—Tesla’s Optimus, for example, needs 12 motors just for finger joints in a single dexterous hand. Based on mass production projections, when humanoid robot production reaches one million units annually, the global coreless motor market will exceed 20.5 billion RMB, with China accounting for roughly 50%. The global market size is expected to reach USD 870 million in 2024 (up 7.41% year-on-year), with China growing even faster at 10.34%, reaching 320 million RMB.

3. Frameless Torque Motors: The Core of Humanoid Robot Joints

3.1 Technological Evolution

Frameless torque motors eliminate traditional housings and bearings, embedding stators and rotors directly into the host equipment for an extremely simplified transmission chain. Their technical advantages manifest in three ways: the elimination of gear reducers reduces energy loss by over 15%; system inertia is reduced by 30%, enabling ±0.05° positioning accuracy; and their wide temperature range (-40°C to +155°C) and shock resistance over 5G meet demanding environments.

Current technical bottlenecks lie in magnetic circuit design and manufacturing processes. Industrial robot joints require torque density >8 Nm/kg. Global leaders such as Kollmorgen (U.S.) use carbon fiber banding, while Germany’s TQ-RoboDrive innovates with epoxy potting technology.

Future evolution focuses on two paths: higher performance and scenario customization. Halbach array magnetic optimization is expected to raise torque density to 12 Nm/kg. Flexible joint modules for collaborative robots and high-integration joint components for humanoid robots will expand multi-scenario adaptability.

3.2 Market Landscape and Demand Forecast

In China, the market shows high application concentration, with robotics accounting for 80% of demand—45% for humanoid robots and 35% for collaborative robots. The competitive landscape features a parallel of overseas dominance and domestic substitution. Kollmorgen and TQ-RoboDrive monopolize the high-end segment, while domestic firms such as HETM (16% market share in 2023) and Han’s Motor (12%) are penetrating the mid-range with price advantages.

Humanoid robot mass production will become the main growth driver. Each robot uses 28 frameless torque motors—14 for linear actuators (with planetary roller screws) and 14 for rotary actuators (paired with harmonic reducers). As production scales up, average motor prices will fall from 1,200 RMB in 2025 to 800 RMB in 2030. Based on this, when annual humanoid robot output in China reaches 5 million units, the frameless torque motor market will exceed 279.5 billion RMB. Tesla’s demand is even more striking, with projected procurement rising from 345 million RMB in 2025 to 27.955 billion RMB by 2027—an 80-fold increase in three years.

4. Technological Trends and Industry Outlook

Coreless motors are advancing toward ±0.01° ultra-high precision to support complex operations like thread threading (accuracy at 0.1 mm level) and piano playing (response time <1 ms). Frameless torque motors are adopting nanocrystalline soft magnetic alloys to improve power density by 30%, meeting the 300% instantaneous overload demand of humanoid robots in running conditions.

Industrialization is accelerating: Tesla's Optimus is expected to enter mass production in 2025, and Unitree’s H1 model is set for delivery in 2024. These two types of motors will share in the trillion-yuan humanoid robot market, with the global coreless motor market projected to exceed 12 billion RMB by 2027, and the Chinese frameless torque motor market expected to reach 280 billion RMB by 2030—jointly forming the core growth pole of intelligent equipment.